In 2024, NagaCorp appointed Political & Economic Risk Consultancy, Ltd. (PERC), an independent third party from the Company, to conduct a research and review on investment risks in Cambodia. Established in 1976, PERC is headquartered in Hong Kong and engaged principally in the monitoring and auditing of country risks in Asia. From this base, PERC manages a team of researchers and analysts in the ASEAN countries, the Greater China region, and South Korea. Corporations and financial institutions use PERC's services to assess key trends and critical issues shaping the region, identify growth opportunities, and develop effective strategies for capitalising on these opportunities.

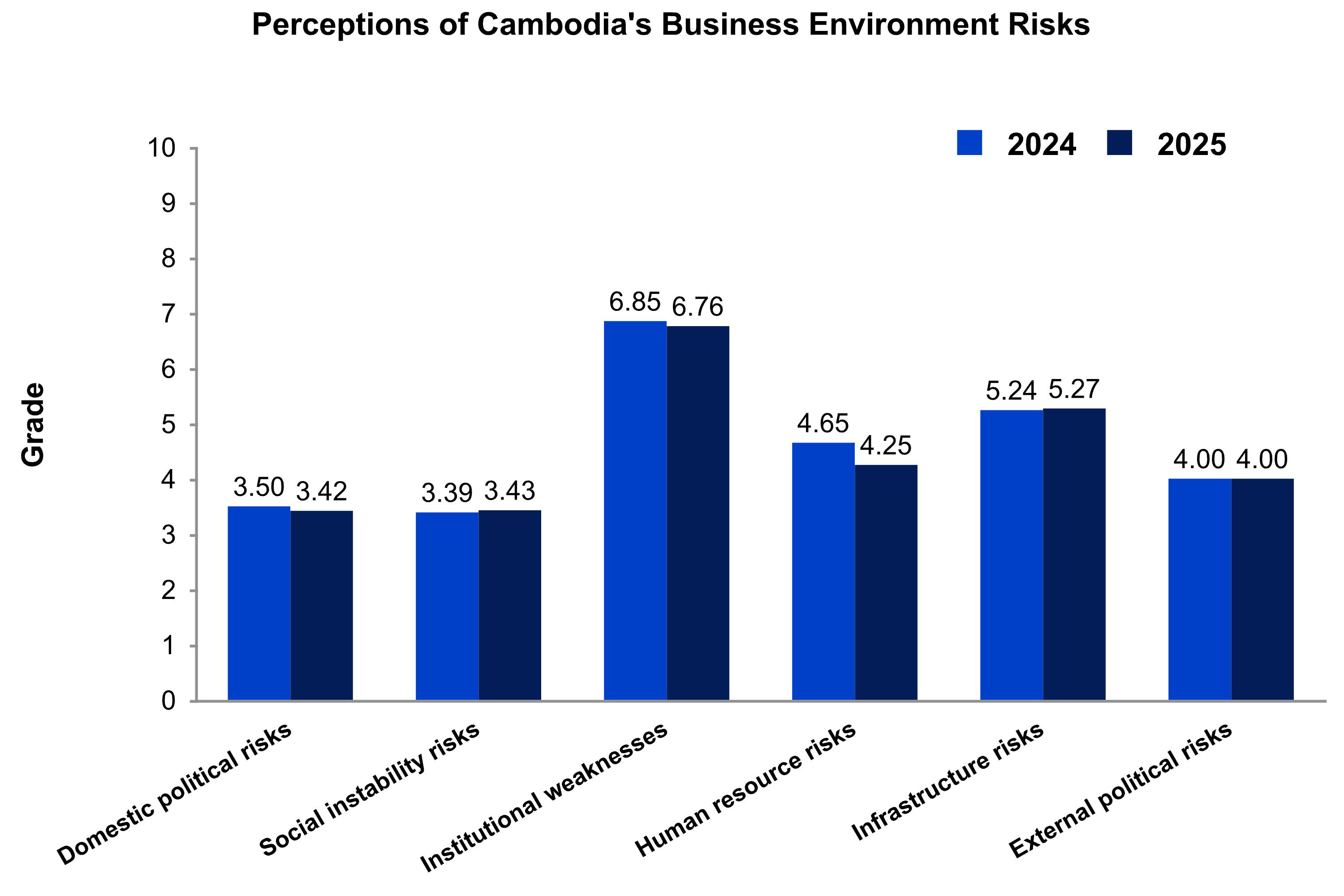

PERC has assessed and reviewed Cambodia’s political, social, investment, and macroeconomic risks related to NagaCorp’s casino, hotel, and entertainment business operations. In arriving at the findings below, PERC has taken into account, amongst others, domestic political risks, social instability risks, institutional weaknesses, human resource risks, infrastructure risks, and external political risks.

Based on the assessments and reviews carried out between mid-November 2024 and the end of December 2024, PERC summarised the findings below:

Grades range from zero to 10, with zero being the best grade possible and 10 the worst.

PERC quantities investment risks in Cambodia through the measure of the following variables:

- Domestic political risks

- Social instability risks

- Institutional weaknesses

- Human resource risks

- Infrastructure risks

- External political risks

Each variable comprises several sub-variables relating to specific aspects of the assessed category. The weighted sum of the grades for sub-variables equals the score of a broader variable, while the weighted sum of the grades of the broad variables defines overall investment risks in Cambodia. PERC has treated each variable as having equal importance or weight.

Summary

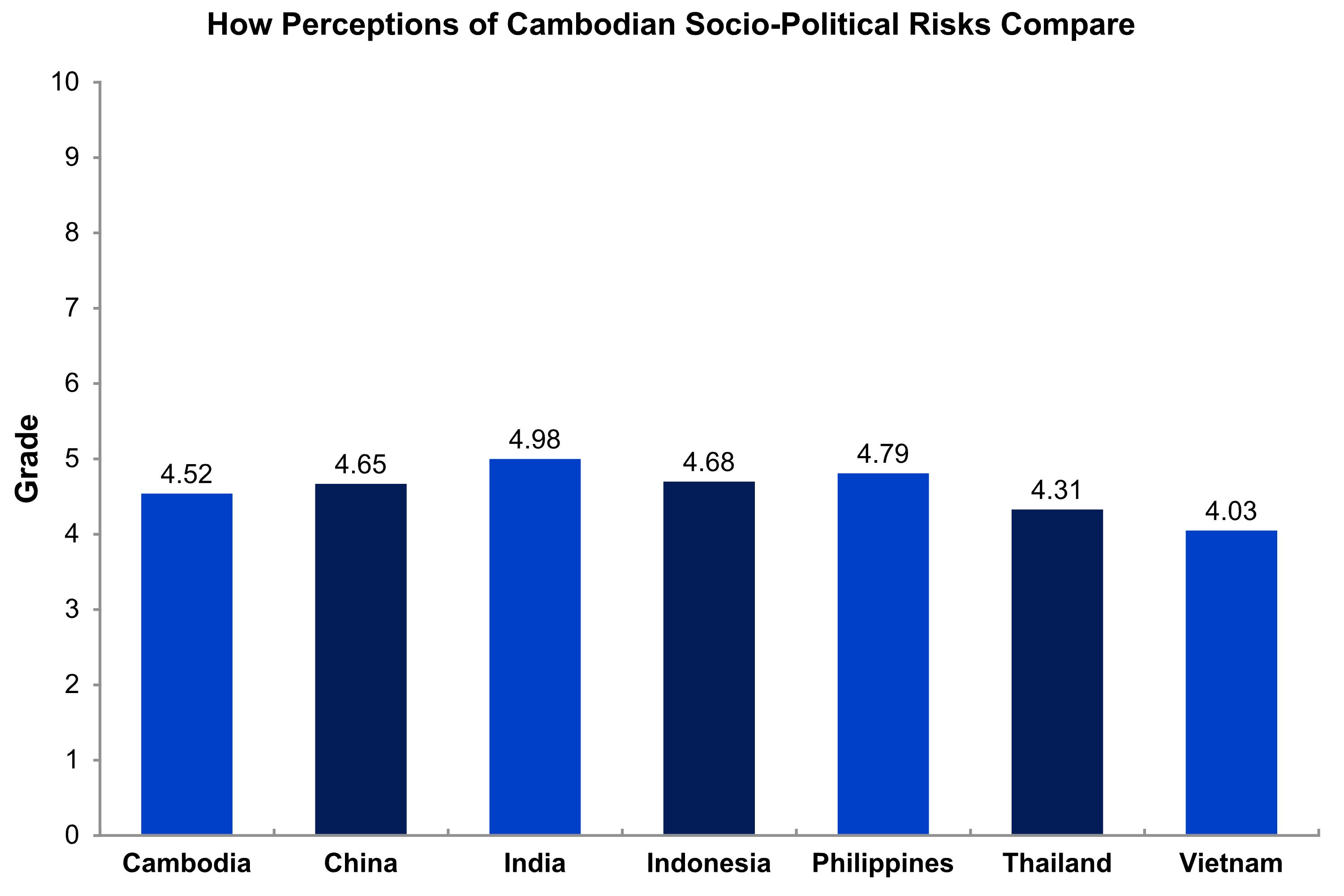

Cambodia’s political and social risks are low and steady, while economic risks are higher for certain sectors like residential real estate, finance, and export-oriented manufacturing than for others like tourism and agriculture.

The basic political system is stable, with a strong executive branch and weak political opposition. The leadership transition, now in its second year, has gone smoothly. There have been no major policy shocks or directional changes, and this type of consistency is likely to continue. The main challenge facing the government is not the threat posed by the political opposition but in dealing with the inertia of a top-heavy bureaucracy and institutions that are still underdeveloped. This will impede the government’s ability to act efficiently as well as raise tax and other revenues required to have the financial wherewithal to invest in development projects after it has covered its recurrent expenses.

This means the government will remain dependent on foreign aid from bilateral and multilateral sources. Mainland China will remain the largest single source of aid and investment, but China’s domestic economic problems could constrain its ability to keep growing its aid and soft-term loans to Cambodia as much as it did in the past. Fortunately, other sources are stepping up their aid, so the overall flow should remain steady and even increase slightly. In addition, the inflow of foreign direct investment is growing, and the overall net inflow of capital should offset what is likely to be a growing current account deficit in 2025 and 2026.

Cambodia’s biggest external vulnerabilities arise from its overdependence on direct investment and imports from China and on exports to the US. The trend in 2024 was for a big increase in Cambodia’s trade deficit with China due to higher imports of equipment and raw materials and a widening of its trade surplus with the US due to higher exports of finished manufactured goods. A risk from these imbalances is that the new administration in Washington might decide to raise tariffs on certain goods the US imports from Cambodia. If this were to happen, exports and the overall economy would be hurt.

In any event, pressure will build on Cambodia to diversify many aspects of its economy, including its import suppliers, export markets, and sources of tourism and foreign direct investment. To a limited extent, this diversification is already taking place. The result has been to broaden its economic links with other ASEAN-member countries as well as with South Korea and Japan. Its most important bilateral relationship is and will remain with Mainland China, but ASEAN links could grow faster. This is especially true in the case of tourism.

A new factor that is complicating the political, social, and economic environments is the growth of social media and artificial intelligence. There are positive as well as negative implications from the growth, and the trick for the government will be to harness the former while controlling or reducing the latter. Among the positive features of the innovative technology is that it provides Cambodia with ways to put in more efficient systems and processes that will improve the performance of institutions. However, the negative features include new ways for critics and special interest groups to spread misinformation.

This is as much a perception problem as an actual one, but that does not mean it is any less important. The actual level of crime has probably decreased slightly in the past year due to the attention it is getting from the government. However, the new negative publicity surrounding the scamming and other activities of organised crime have been amplified by social media discussions, media reports, and TV shows and movies in other countries that have misrepresented the truth so their specific audiences can identify with storylines. Representing the facts accurately was not a major consideration.

Positive Developments

- Confidence in both the quality and staying power of the new government headed by Prime Minister Hun Manet has been fortified by the test of time. Various political factions are being accommodated in ways that promote the political status quo and systemic stability.

- One of the more notable features of Cambodia’s labor force trends has been the steady improvement in overall skill levels and the shift in the number of workers from the informal sector to the formal sector. There are several reasons for this, including a push by the government to register more individuals and businesses in the formal sector. Those same reasons are likely to keep the trend improving in the years ahead. The adjustments existing investors had to make during the COVID years show they have a great deal of flexibility to hire and fire workers to suit changing economic conditions.

- Cambodia faces no direct military threats of consequence. At a time when military violence is intensifying in parts of the world, Cambodia not only is peaceful and secure but also seems to be less vulnerable to the indirect fallout from these foreign conflicts than are many other countries. This can be seen from the way the country has continued to regain economic momentum over the past two years despite Russia’s war with Ukraine, the Israel-Hamas conflict, and the recent collapse of the Assad regime in Syria.

- China will remain an important source of visitors to Cambodia, but its share will be slow in returning to its pre-pandemic level. The biggest increase in visitors will be, first, from neighbouring Thailand, Laos, and Vietnam, followed by non-adjacent ASEAN countries like Malaysia and Singapore. Korea and Japan are both likely to hold their own in the top 10 sources, along with the US and France, while new growth markets are likely to include Russia, India, and several Middle East countries.

The Challenges

- The main drags on growth in 2024 were construction and real estate. They are both going through a correction that will continue to have an adverse impact on other sectors in 2025, including the financial industry.

- Risks from being so dependent on the US as a market for its manufactured goods will keep up the pressure on Cambodia to diversify its exports more. One of the bigger dangers for 2025 is that the new administration in Washington might raise tariffs on imports from Cambodia, causing short-term disruptions that hurt Cambodia’s exports, dampen certain foreign direct investment inflows, and cause headwinds for economic growth.

- Threats against persons and property have become a bigger issue, in what is essentially a cross-border problem with both perpetrators and victims being foreigners. The challenge is as much reputational as it is the actual magnitude of crime. The adverse publicity in the form of TV shows and movies in other countries could act as a deterrent to some foreigners visiting the country by exaggerating the dangers that actually exist.

- Hurting Cambodia’s competitiveness is the high cost of electricity and fuel. Cambodia’s electricity tariff is 30% higher than Thailand’s, and 50% more than Vietnam’s. The cost of fuel is one of several aspects of Cambodia’s internal transport and logistics difficulties, which some surveys rate as the single biggest infrastructure deficiency.